BEARS Tax? Illinois Representative Proposes Bold Solution to Stadium Dilemma

Chicago, IL – The debate over the Chicago Bears’ future home took a new turn this week as an Illinois state representative proposed a novel funding solution: a “BEARS Tax” to help finance a new stadium.

Representative Marty McGuire (D-Chicago) introduced the proposal on Monday, suggesting a small tax on hotel stays, rental cars, and entertainment venues in Cook County to generate revenue for a potential stadium project. The idea aims to ease the financial burden on taxpayers while still keeping the Bears in the city.

“The Chicago Bears are more than just a football team—they’re an institution,” McGuire said in a press conference. “If we want to ensure they stay in Chicago and thrive, we need a creative funding solution that doesn’t fall squarely on the shoulders of Illinois taxpayers.”

A Response to Stadium Uncertainty

The proposal comes amid uncertainty over the Bears’ plans. The franchise had initially purchased land in Arlington Heights, with intentions to build a state-of-the-art stadium there. However, recent discussions have opened the door for the team to remain in Chicago, provided a feasible stadium plan emerges.

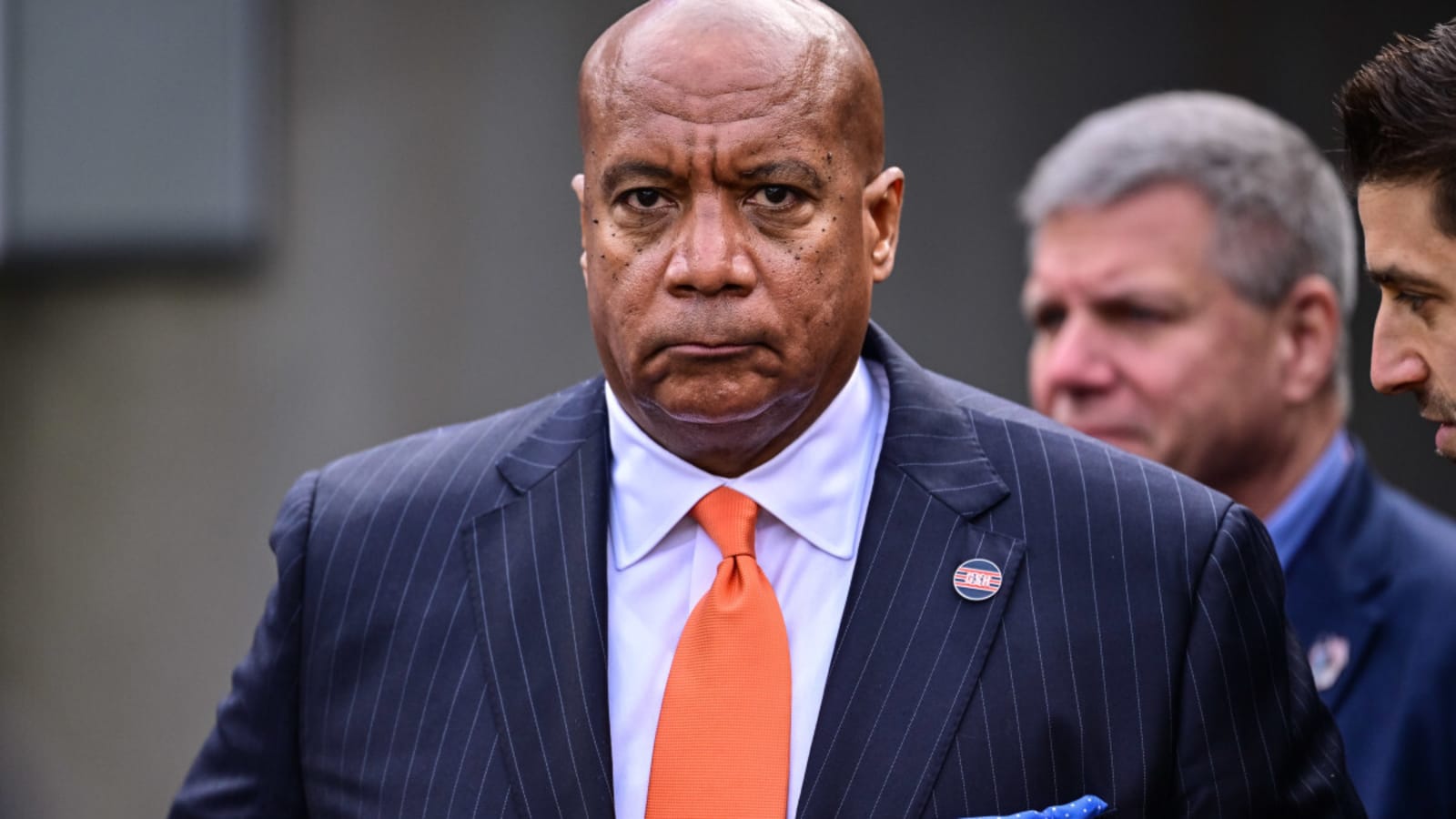

Mayor Brandon Johnson has pushed for a downtown or South Loop stadium, potentially near Soldier Field. But financing such a project remains a significant hurdle, and McGuire’s proposal attempts to bridge that gap.

“This plan spreads the cost among visitors and entertainment consumers rather than relying solely on taxpayer dollars,” McGuire added. “It’s a fair compromise that benefits both the Bears and the city.”

Mixed Reactions from Officials and Fans

The proposed “BEARS Tax” has sparked mixed reactions. Some local officials support the idea, arguing that a thriving sports franchise boosts local businesses and tourism. Others worry about the impact on tourism if visitors face additional fees.

“I understand the intent, but we have to be careful not to overburden visitors,” said Alderman Carlos Ramirez (7th Ward). “We want to attract people to Chicago, not push them away with extra taxes.”

Bears fans also appear divided. Some see the tax as a necessary step to keep the team in the city, while others argue that the franchise, valued at over $6 billion, should cover stadium costs without public assistance.

“Why should we pay for their stadium when they’re already making millions?” said longtime fan Dave Sullivan. “If they want a new place, let them pay for it.”

What Comes Next?

McGuire’s bill will head to the Illinois General Assembly for debate in the coming weeks. If approved, the tax could be implemented as early as next year, depending on stadium negotiations.

Meanwhile, the Bears organization has yet to publicly comment on the proposal. Team officials continue to explore stadium options, weighing the benefits of staying in Chicago versus relocating to Arlington Heights.

As the debate continues, one thing is clear: the future of the Bears’ home field remains one of the biggest sports and political stories in Illinois. Whether the “BEARS Tax” becomes law or not, the fight to keep the team in Chicago is far from over.